I have never written about a specific credit card on BargainBabe.com until now. Most of you have enough credit cards or use debit cards, right? But this credit card from Sustain:Green is truly unusual: every dollar you spend saves a rainforest. Okay, not the entire rainforest, but a tiny part of a huge one in Brazil.

I have never written about a specific credit card on BargainBabe.com until now. Most of you have enough credit cards or use debit cards, right? But this credit card from Sustain:Green is truly unusual: every dollar you spend saves a rainforest. Okay, not the entire rainforest, but a tiny part of a huge one in Brazil.

I’m writing about this unusual credit card today because I believe in taking personal responsibility for climate change.

Note: there are no affiliate links in this post.

The Sustain:Green MasterCard is biodegradable, too

The most environmental credit card in existence

- Sustain:Green launched on Jan. 20, so getting one now means you are a trend setter

- If you put at least $417 a month on the card, you’ll be earning the equivalent of 3.4% cash back

- Get 5,000 pounds of carbon offsets when you swipe the first time

- Then, for every $1 you spend you get two pounds of carbon offsets

- No annual fee

What the heck is a carbon offset?

A carbon offset is a reduction in emissions of carbon dioxide or greenhouse gases made in order to compensate for an emission made elsewhere. When you buy an offset, you fund projects that reduce greenhouse gas emissions.

Carbon offsets are purchased through the American Carbon Registry. Card holders can also calculate their carbon footprint and track their reduction online.

How many pounds of carbon am I really making?

Burning one gallon of gas creates 20 pounds of carbon dioxide, approximately. So charging $10 a day on the card, which would earn you 20 pounds of carbon offsets, would be enough to completely off set burning one-gallon of gas.

The math is totally confusing me

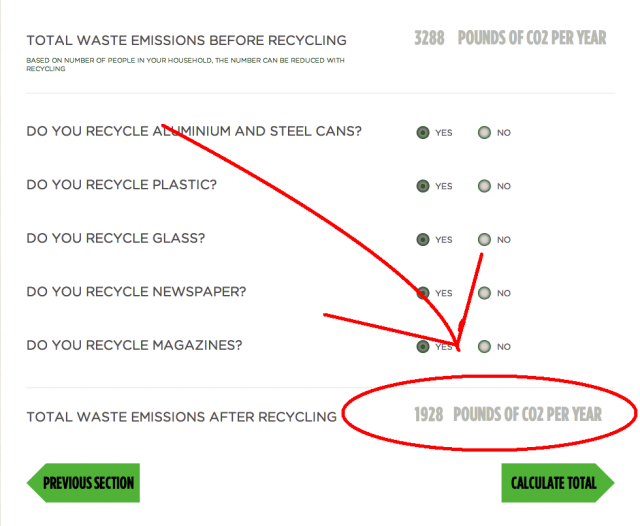

I know, it confused me too. Then I found this simple carbon calculator on the Sustain:Green site. I tapped in a few numbers about my household’s driving and home heating oil useage, and guess what? My family creates 1928 pounds of carbon dioxide a year. Yowza. That’s a lot of nasty gases that the earth has to absorb.

(We actually create 3,288 pounds of carbon dioxide but our recycling brings it down to 1,928.)

If you check out the calculator, which is kind of fun, look for your total carbon output BEFORE you click “CALCULATE TOTAL.” I circled it in red below.

When you click “calculate total,” your total should appear with more stats on your carbon production and what you can do about it. I hit a bug and went to a more generic page, but the folks at Sustain: Green told me they have resolved the issue.

Is there a prepaid option?

Yes, a prepaid credit card is coming later this year. It will also have rewards, which most prepaid cards don’t have.

What about a debit card?

Not yet, sorry.

What is the interest rate?

You’ll get a 1.99% Introductory APR on Purchases and Balance Transfers for 6 monthly billing cycles after account opening, then 12.24% to 18.24% APR. See this page for more.

How does Sustain: Green make money?

Sustain:Green is a start up seed funded by CEO Arthur Newman a former Wall Street Analyst, and other angel investors. The company receives compensation from Commerce Bank for every card issued, which supplements the angel investment. The card is issued by Commerce bank.

Why should I use this card again?

“After recycling, reusable grocery bags, and turning down the thermostat, the options most people have to reduce their carbon footprint usually fall into three categories, too difficult, too expensive, or not possible,” said Arthur Newman, Co-Founder and CEO of Sustain:Green. “Just by using our card for purchases they would make anyway, consumers can shrink their carbon footprint for free, everyday, while also helping to preserve rainforests critical to combating climate change. We hope they will use the card in conjunction with other carbon reduction lifestyle changes, such as fuel efficient transportation choices.”

Leave a Reply