The price of solar energy has dropped rapidly. Via Shutterstock

I keep hearing that solar panels are getting so cheap that they are going to cost as much as getting electricity from the grid as early as 2016. That’s practically tomorrow! With a generous 30 percent rebate from the federal government, I set out to find out how much solar panels cost, when they make sense, and how quickly you get your investment back.

==> See energy rebates and credits you are eligible for

How much DO solar panels cost?

Full disclosure: Part of me is writing this post to prove my Mom wrong. My Mom keeps telling me that her neighbor, who recently installed a huge solar array on her roof, pays $100 a month to lease the solar panels. She figures it’s a terrible deal because her neighbor still has a gas bill to pay. At which point I ask her if it is possible that this neighbor has switched all of her utilities to be electric, nixing a gas stove and gas heat? My Mom isn’t sure. It irks me that she assumes her neighbor is also paying a gas bill and is therefore losing money on her solar array, when it’s entirely possible that she is getting a great deal on a very clean energy source.

How much do solar panels cost?

The cost of installed solar panels is $3 to $7 per watt, depending on where you live. A small residential solar arrays would be about three kilowatts (three thousand watts) and cost roughly $15,000. On the large end, an eight kilowatt array (eight thousand watts) would run you about $40,000. Generally, the bigger the system, the lower the cost per watt. Prices can vary quite a bit depending on local labor costs. A recent post on CleanTechnica said:

The bulk of the price of going solar is now the “soft costs” (installation, permitting, etc.) rather than the solar panel cost. Again referencing the latest US Solar Market Insight report, the average installed cost of a residential solar panel system was $4.72/watt. However, prices vary tremendously by region. “Common residential system prices ranged from less than $3.00/W to just above $7.00/W,” the Solar Energy Industries Association writes. The total price of a system, of course, varies tremendously based on the size of your roof and your electricity needs.

That gives you a rough idea, whether you’re just curious or eyeballing solar panels for your self. For more detailed info, I found this page helpful in examining the cost of solar panels.

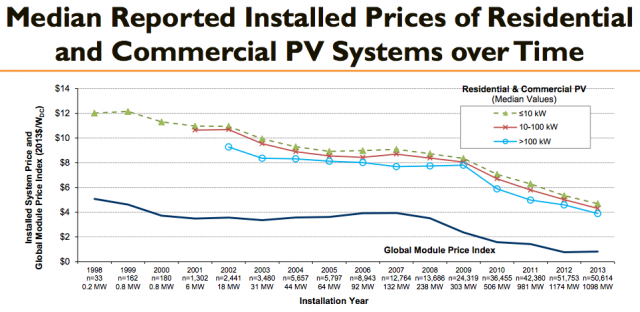

The cost of installed solar panels has dropped rapidly in recent years, as this chart from the U.S. Department of Energy shows.

What about leasing?

When you lease solar panels, you essentially are paying a company for the electricity your panels generate that month. They own the panels and maintain them, while you pay a relatively low monthly fee for solar energy.

The main difference is upfront cost. With leasing, there is no upfront cost. When you buy a solar array, all the costs are upfront. Many solar companies have a 20-25 year warranties, and solar panels may generate electricity for 30-50 years after installation. So the investment is a long term one for sure.

The $15,000-$40,000 price tag is before a generous 30% federal tax credit on solar panels, however.

The solar panel credit works to directly lower the amount of taxes you owe. It is not a check from Uncle Sam. So if you spend $20,000 to install solar panels, you would qualify for a $6,000 tax credit. Come tax time, if you owe $8,000 in taxes, you’d apply the $6,000 tax credit and only owe $2,000 in taxes.

If you were expecting a $0 tax bill, you could adjust your withholdings at work so that you would owe $6,000 in taxes, then apply the $6,000 credit and end up with a $0 tax bill.

If you owed, say $2,000 in taxes, after applying the $6,000 credit you’d owe no taxes and have a $4,000 tax credit apply to rollover and apply next year.

The federal rebate on solar panels currently is set to expire Dec. 31, 2016, so it’s unclear if you can roll over a tax credit after it expires. Ask your accountant.

When do solar panels make sense?

- When you have a south-facing roof that gets lots of sunshine (a west-facing roof may work, too)

- When you have cash saved to purchase the panels outright or are open to leasing them for a low monthly payment

- When you have a large electric bill, especially if it is large because all or many of your appliances and systems use electricity (as opposed to natural gas or home heating oil)

- If you are able to convert your energy systems to electricity (and away form natural gas or home heating oil)

- If you plan to stay in your home for long enough to make your money back on the solar panels. Calculate your payoff date below.

How quickly will you get your investment in solar energy back?

It varies depending on your location and array and price, but expect to see your payback in fewer than 10 years. And depending on your state incentives, your payback could be as low as three years. If your array can also power your electric car, the payback period could be even shorter. The site GreenBuildingAdvisor says by 2016, solar energy will be as cheap as buying electricity from the grid in 47 states:

If the current federal tax credit for solar equipment remains intact, electricity generated by photovoltaic (PV) panels will cost no more than electricity provided by local utilities in 47 U.S. states by 2016, according to a report from Deutsche Bank.

What info do I need to calculate my solar energy payback period?

- Grab your electricity bills for the past 12 months. Add up how much electricity you used in the past year.

- Scan you bill for how much you pay per kilowatt. The national average is $.13 per kilowatt. Here in Rhode Island, we pay $.17 per kilowatt. Our bill is actually $.20 per kilowatt because we pay an up charge to get all of our energy from wind and small-scall hydro. No coal for us! Our bill is about 17% higher because we pay for green energy.

- Call a solar installer near you – both a company that sells them outright and one that leases them. I’d call three of each company type for quotes. It’s a pain but the more people you talk to, the more you’ll know about the process and what your payback period is. Plus, it’ll help you decide which option to go with and which company you want to work with.

The federal tax credit reduces your tax liability, not your balance due. So, in your example, if you had a $10,000 liability and $12,000 in withholding so you would be getting a $2,000 refund before the credit, you would now get an $8,000 refund. You could adjust your withholding so that you received the money during the year rather than waiting for a refund. If you had a $4,000 liability and $12,000 in withholding (so an $8,000 refund) before the credit, you would now have a $12,000 refund ($8,000 + $4,000 credit) and $2,000 of credit to be carried over. In general, credit carryovers do not expire if the credit expires, so you would still have time to use it.

One of the most difficult aspects in determining payback timeframes is that you need to make an assumption as to how much power rates will rise. Also, at least in Los Angeles, you are only allowed to install a system that meets your current needs, so if you’re thinking of buying an electric car you should do so before buying your system.

I do have a solar system which I purchased and am loving my near -0- electric bills.