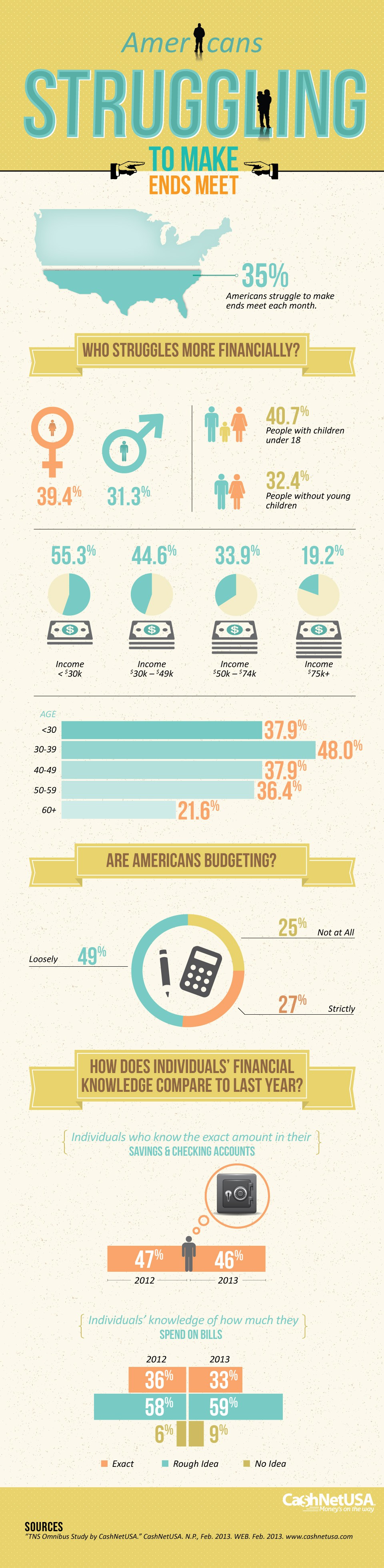

I was shocked by a stat that said a full third of Americans – 35% – are struggling to make ends meet. And that women are disproportionately affected, which surprised me because I heard so much about the “hesession,” i.e. men losing jobs at a faster pace than women because manufacturing and other male-dominated fields saw greater job losses.

Do the numbers in this infographic ring true to you?

Struggling to make ends meet is really independent of income. I have a friend who makes more than $200k a year, and they are ALWAYS, ALWAYS “broke.” Any time they have an unexpected repair, they have to frantically scramble to cover it, and sometimes, they have to go without things like heat or air conditioning until the next paycheck or two come in.

I think very few fully employed people would actually struggle to make ends meet–meaning for their basic necessities–if they would budget wisely and shop carefully. Of course, we all want more than what we can pay for, and when you make less, that list is longer, but as far as food, shelter, clothing, utilities, etc., most of the gaps are a result of not prioritizing and making good decisions.

Of course, if you throw unemployment into the mix, everything becomes much chancier!

@Jenny @ Frugal Guru Guide Good point! Struggling to make ends meet is objective, and the infographic did not provide info defining that phrase. I definitely know people who make more than I do, and they are under financial pressure. I try not to judge, though it does occur to me that some of the things they are buying could probably have been passed over. To each their own!

I agree with you two ladies……My husband and I make much less than many of our friends and they never have any extra money and are always crabbing about the fact! It is a matter of budgeting……..We are not struggling, but there are MANY things we would like to do, but can’t, because of our budget. In our defense, my credit card bills could be paid off with savings if worse came to worse. But like I’ve said before, with a 0% interest for 18 months, I’m using their money instead of ours! And not for frivolous purchases either. Car parts, landscaping equipment (my husband does our gardening and trimming) etc. goes on the card. And, it’s all attitude – my husband thinks we’re “poor” – I know we are not! We have a roof over our head and we can pay our bills…I don’t think in this day and age you can ask for very much more. Enjoy what you have.

@Michelle Ventresca Being poor or rich is largely a state of mind! If you want more, then you feel poor. If you are happy with what you have, you are rich!

I keep my goals foremost – retirement – in my brain when considering a purchase. Do I want to spend $2,000 extra to have someone else build our backyard fence, or do I want that money in my retirement account? This past weekend we FINALLY finished our backyard fence OURSELVES and even though it was a lot more work than we anticipated, and Hubs and I got into a few skirmishes, I’m so proud that we did it ourselves and saved a ton of money! The pride of DIY makes me feel rich!

We do many projects ourselves that other people in the neighborhood have people come and do for them (and then they complain that they have no money!). My husband set our entire backyard with concrete blocks so we’re not walking on dirt! It took many weekends, but it’s something we’re proud of! Now that we’re not spring chickens anymore (my hubby is 60) we have hired a guy to cut some dead branches off of our willow tree. We don’t have a ladder tall enough, and I don’t want any visits to the emergency room!

Prior to the time I retired from teaching, and knowing my income would be cut by more than 50%, I looked at the large ticket items (car payment, mortgage, etc.) that I was responsible for, and made a concerted effort to reduce/pay off as much as possible before I retired. Since then, I’ve been quite frugal, limiting expenditures to what could be covered on a cash only basis, as well as paying off my credit card bills (used when there is not option for payments) in full every month. While I definitely go without many things these days, I do not feel deprived nor sorry for myself. It’s amazing what one can adjust to when it’s a matter of necessity. Only one of my 3 sons has any sense of the financial realities of life, and he’s the only one with any savings at all. Sad.

@EllieD You are very responsible to plan for your finances so far in advance and make many concessions to live within your means. It always drives me crazy when someone says casually, “Why should I save for retirement when nobody else is? The government will take care of us.”

Why do you think two of your three sons don’t have a sense of the financial realities of life? I’m guessing you did quite a lot to talk to them about money and finances. Where do you think they went in another direction?

The two older “boys” are my stepsons, although they were only 5 and 7 when my husband (their father) and I married. Their mother was very irresponsible about many things, and was not truly cut out to be a parent. She’d had a difficult upbringing herself, and didn’t know what to do. I did my best with them, but too many times my husband would “help them out” of financial binds, and consequently neither one learned financial independence, starting with always having a savings account. I was more successful in guiding our youngest son, who learned by seeing a positive example. Of course, I had the freedom to be a bit tougher with him, as there wasn’t a third wheel causing difficulties. One of the difficulties with being a stepparent is that there are limits to our influence. Tough love is often the kindest and most productive road to follow!

@EllieD You are wise not only in money matters but in matters of the heart! It must have been very hard to step back and let your husband and his first wife handle money with their two sons. But I wonder if the two of them might have had a hard time taking advice from you. I know I certainly would have done the opposite of anything my step mother suggested!

My philosophy on tough love is mixed. My mother is an ace in it, and it mostly worked with me and my older two sisters. But not so well with the younger ones. They just didn’t respond to it. We’re getting off topic! Time to start a relationship blog. 🙂

I don’t know how wise I am, but I do have quite a bit of common sense. I decided to limit my input to asking them to observe the rules of conduct expected of all 3 of them. When their mother died many years ago, they eventually began to turn to me for advice on more things, including money matters. Of course, by then it was a bit late. Still, I continue to encourage them to make smarter choices. One of them is married to a smart, strong woman whom I adore and get along with extremely well, while the other has continued to struggle with most aspects of his life. So sad to have to just stand by and watch. Where’s the magic wand when it’s needed?

Thanks for sharing my infographic @Bargain Babe! Our definition of “making ends meet” was having enough money to live on and having enough income to meet all your expenses. Thanks again for sharing it!

@Nivene @ CashNet That’s a fairly broad definition of “making ends meet” and one that leaves room for subjectiveness, i.e. a person who makes $150,000 but can’t pay all their bills because they spend irresponsibly. A better definition would be to ask people if they can pay their housing, utility, food, medical, and gas bills. Those are the true necessities, no?

And yet there are lots of people who struggle with housing because the bought WAY more house than they can afford, and people who can’t pay the power bill because they blew their paycheck on the Coach purse, and people who end up with huge medical bills because they put their satellite TV ahead of catastrophic health coverage, and people who run out of money for food because they buy really, really expensive things in the grocery store. (Sadly, I know people who have done many of these things, despite healthy incomes. 🙁 )